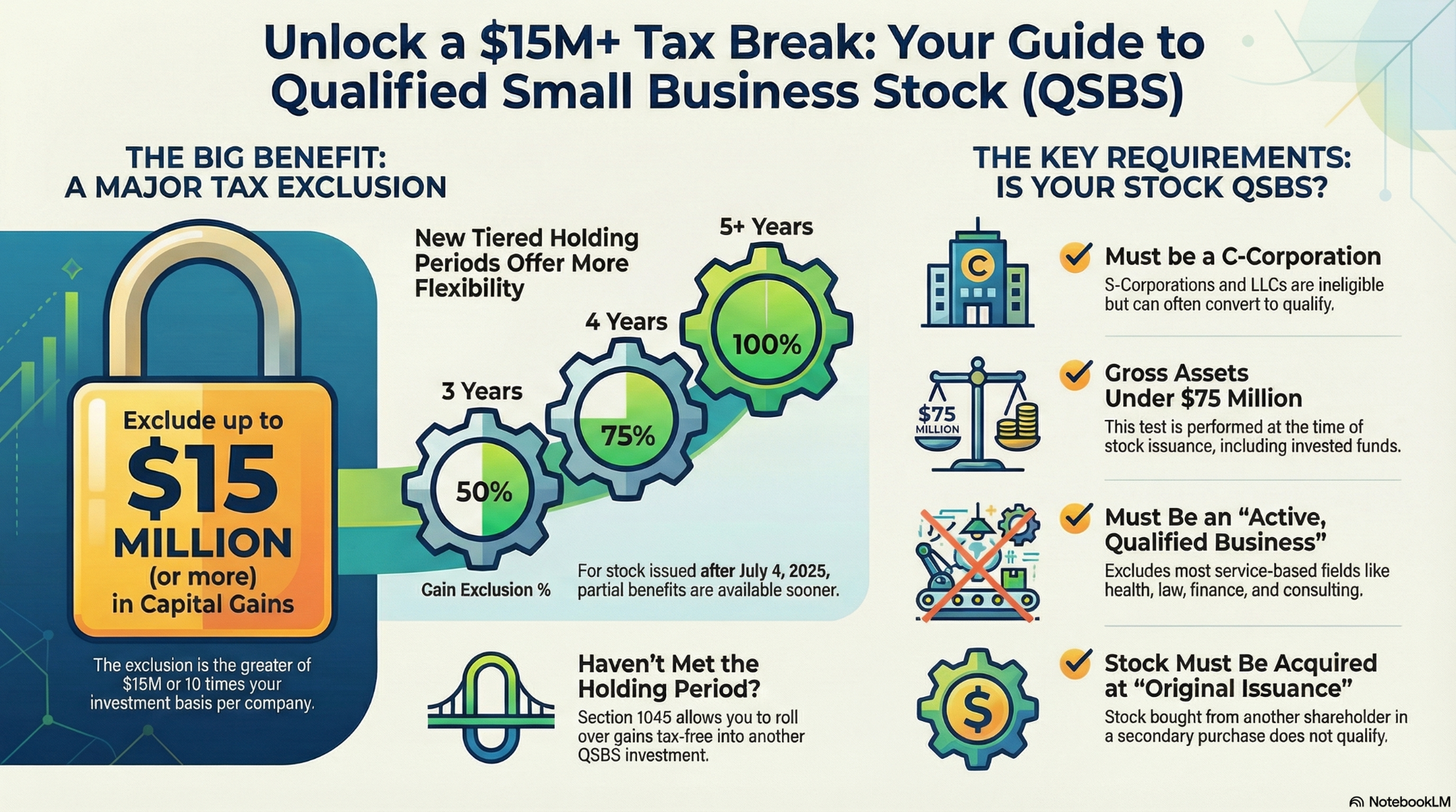

This post features a concise infographic explaining the major tax exclusion available under the Qualified Small Business Stock (QSBS) rules. If you’re a founder or investor, this visual guide outlines the potential to exclude up to $15 million (or 10× your investment basis) in capital gains, the tiered holding periods, and the key requirements your stock must meet to qualify. Check out the graphic below for a quick overview.